North Dakota Oil and Gas Tax Revenue Study Released

Bismarck, N.D. – The North Dakota Petroleum Council (NDPC) and the Western Dakota Energy Association (WDEA) this week released the results of a North Dakota oil and gas tax revenue study they jointly sponsored. The purpose of the study was to review the oil and gas extraction and gross production tax collections by the state of North Dakota, from 2008-2018, and to detail where and how that funding has been used. The study breaks down the revenue distribution by the programs and political subdivisions receiving the funds and tracks how the revenues have been used through different state funds and distributions authorized by the legislature.

From 2008-2018, oil and gas extraction and production taxes have raised almost $18 billion for the state, which accounts for almost 44 percent of total tax revenues collected by the state during that period. Over the last five years alone, oil and gas extraction and production taxes accounted for more than 50 percent of all tax revenues collected by the state. “We thought it was important to compile this data and push this information out to the public,” said Ron Ness, President of NDPC. “We hope it is useful to our state legislators currently considering the state budget and spending levels for the next biennium.”

“The oil industry benefits the entire state, not just the west. We are excited to share this information, so people have a clear picture of how their government services are being funded.”

“The oil industry benefits the entire state, not just the west,” said Geoff Simon, Executive Director of WDEA. “We are excited to share this information, so people have a clear picture of how their government services are being funded.”

“We appreciate the efforts of the NDPC and WDEA in compiling this information,” said Rich Wardner, ND Senate Majority Leader. “During the legislative session, as we debate tax and spending bills, this information will be critical in ensuring lawmakers have a full understanding of where tax revenues are coming from and where they are being spent.”

This report is a compilation of publicly available tax collection data conducted by Brent Bogar of Jadestone Consulting. Copies of this report have been delivered to all state legislators and it will be made available on the WDEA website at taxstudy.ndenergy.org.

Related Articles

Study: 2023 Economic & Job Contributions of the Oil and Gas Industry

The oil and natural gas industry in North Dakota accounted for $48.8 billion in gross business volume, 63,830 jobs and over $3.8 billion in state and local tax revenues in 2023, according to a study conducted by North Dakota State University Department of Agribusiness...

2024 Oil & Gas Tax Revenues Study: How North Dakota’s Energy Industry Fuels Communities

The 2024 Oil and Gas Tax Revenue Study highlights the critical role of oil and gas tax revenues in sustaining North Dakota's economy and improving the quality of life for its residents. Since 2008, over $32 billion has been generated from oil extraction and production...

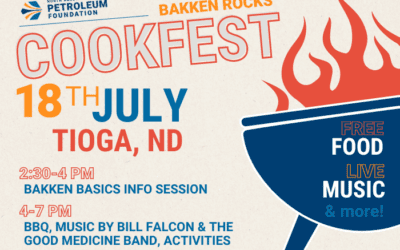

BAKKEN ROCKS COOKFEST

BAKKEN ROCKS COOKFEST COMING TO TIOGA, ND ON JULY 18Tioga, N.D. (July 11, 2024) –The 16th Annual Bakken Rocks CookFest is bringing its festivities to Tioga on July 18th. Held each summer in the oil patch, the Bakken Rocks CookFest offers residents the opportunity to...